This may relieve him of burdens associated with the gift. A donee may repudiate or disclaim a gift on becoming aware of it.

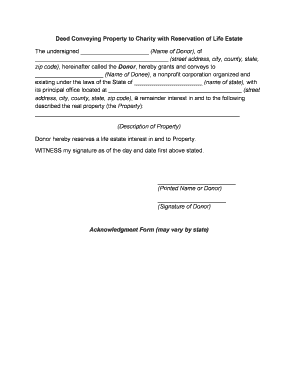

A gift once given cannot be taken back if it is absolute.Ī person cannot be compelled to take that which he does not wish to accept. This is also the case where it is onerous in nature.Ī gift once given cannot be revoked even if before it comes to the donee’s knowledge. It is presumed from silence, even if the donee is not aware of the gift. He may, however, make the requests which may be taken into account by his beneficiaries and successors AcceptanceĪ gift need not be expressly accepted. There is no property in a dead body so that a person may not will it to a third person. In this case, the rights under the trust are a chose in action. However, limited interest and rights may exist under a trust. Interests cannot be created directly in goods. Delivery must be accompanied by must the intention to pass ownership. Movable property can be transferred between persons by delivery. A gift of real property must be perfected by deed as equity will not generally aid a volunteer. This includes titles of honours, dignity and certain payments from public sources.Ī gift of property, real property is referred to as a voluntary conveyance. Certain types of property are unalienable at common law or by statute. Generally, all types of property may be subject to a gift. Where the asset is restored after an alleged and disputed gift, the gift is ended. The donor must have the legal competence to transfer the asset and the donee must be competent to receive what is intended to be given. He has the power to make a legal binding transfer.Ī gift requires giving and taking. A declaration of trust may constitute a gift.Įvery person who has legal capacity may dispose of his assets by gift or any right in them to which he is absolutely entitled. Ownership of movable property may transfer by delivery. Be that property requires transfer by the way of conveyance or equivalent assurance.

Gifts may be given where the property is transferred according to its nature. In certain cases where the donor makes, transfers property in expectation of death, it is treated for tax and certain other purposes as given on death.Ī gift involves the intention of the asset to be transferred with the intention that the donee retains the thing without any obligation to restore it or undo the transfer. It is usually contrasted with a bequest or legacy under a will in that the donor is still alive. A gift is a transfer of property gratuitously.

0 kommentar(er)

0 kommentar(er)